What's New in Research

This page displays the most recent work of THDA's Research and Planning department. Reports are also stored in a permanent location elsewhere on the Research and Planning page.

THDA Mortgage Report: Calendar Year 2023

In 2023, even with a limited inventory of homes at THDA’s purchase price limits, with the help of its approved lenders that originate mortgages, THDA was able to reach potential borrowers, and make their dream of homeownership possible. In 2023, both the total number and dollar amount of THDA loans funded were higher than the prior year. Nearly $740 million first mortgage loans were created for 3,220 homebuyers who used THDA loans, in addition to $35 million second mortgage loans for nearly 3,100 borrowers who needed assistance for downpayment and closing costs. This report explores THDA's annual mortgage activity and places it in context of the broader housing market.

[February 2024]

2023 Tennessee Housing Market at a Glance

Safe, sound, affordable housing options are essential for Tennesseans’ quality of life, including expanded education opportunities, stronger health outcomes, and increased economic mobility. In the four years since the release of the last Housing Market at a Glance Report, Tennessee has experienced a great deal of change in how and where people live. Following the COVID-19 pandemic, domestic and interstate migration as well as shifts in the economic functions of our world have reshaped the current housing market. For these reasons and more, the Housing Market at a Glance examines the current state of housing in Tennessee by highlighting the key trends in the state’s demographics, housing market, and other issues. Consider pairing this analysis with THDA’s Housing Indicators.

[November 2023]

Tennessee Home Loan Trends in 2022: Analysis from HMDA Data

Key findings from this year's HMDA report indicate that 2022 is the first year since 2011 that home purchase mortgage loan originations in Tennessee declined from the previous year. Nonetheless, mortgage activity in Tennessee is still consistent with long-term trends present since 2004, demonstrating a steady increase yielding twice the mortgage volume in 2022 than in 2011. High interest rates and increased home prices made the cost of homeownership significantly increase in 2022. In 2022, the median estimated monthly payment for principal and interest increased to $1,625. The share of loans for Black borrowers remained steady, slightly decreased to 7.3% in 2022 from 7.6% in 2020 and 2021. Although Black borrowers still received the greatest share of higher-priced loans in all five years, the proportion of them receiving higher-priced loans declined against the increasing trend for all other races in 2022.

[November 2023]

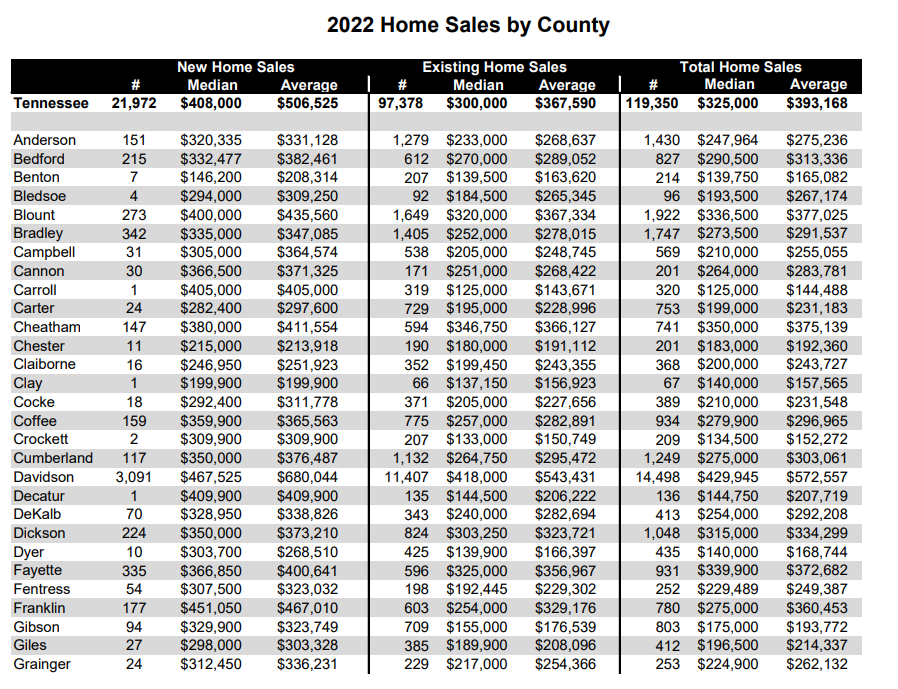

2022 Home Sales: New and Existing Homes

Statewide, total home sales in 2022 declined slightly from a record number of sales in 2021. After ten straight years of growth, there were a total of 119,350 homes sold in 2022, compared to 138,305 in 2021, which represented the year with the most homes sold since THDA began receiving these data in 1992. While the quantity of homes sold declined slightly from 2021 to 2022, the median price did not. In fact, the median home sale price rose to $325,000 which represents the highest nominal median sales price in state history and accounts for the twelfth consecutive year of an increase in median home sales price. This increase in home sale price was unevenly distributed by county, such that some counties, more than others, in particular drove this price increase. Nonetheless, almost every county experienced an increase in the sales price from 2021 to 2022.

[August 2023]

Mortgage Costs by Race/Ethnicity in Tennessee: Analysis from 2018-2021 HMDA Data

This brief utilizes HMDA data from 2018 to 2021 to better understand how the costs of mortgages as measured by interest rates, rate spread, high-priced mortgages, and total loan costs have changed over this period and how they vary for borrowers of different racial and ethnic backgrounds. We find that almost all borrowers benefitted from declining costs over this period. However, Black, Hispanic, and low to moderate income (LMI) borrowers continued to rely heavily on non-conventional mortgages. Furthermore, they experienced higher relative costs in comparison to other groups for the mortgages they did acquire. As a result, they often paid higher overall and higher relative costs by loan amounts compared to their counterparts.

[May 2023]

Refinance Loan Trends in Tennessee: Analysis from 2018-2021 HMDA Data

This brief utilizes HMDA data from 2018 to 2021 to better understand how refinance loans were utilized by Tennesseans before and during the COVID-19 pandemic. Despite the benefits of refinancing one’s mortgage, we find that, in Tennessee, refinance loan originations were significantly lower for Black and low or moderate income (LMI) homeowners than their counterparts. We also find that denial rates alone are not a sufficient explanation of the racial disparities in refinance loan originations.

[April 2023]

2022 Investments and Impacts Report

This report develops a comprehensive framework to estimate the economic impact of THDA activities in providing safe, sound, affordable housing options to households of low- and moderate-income. We reviewed THDA programs, including loans and grants to determine the scope and monetary flows of each program’s activities.

[March 2023]

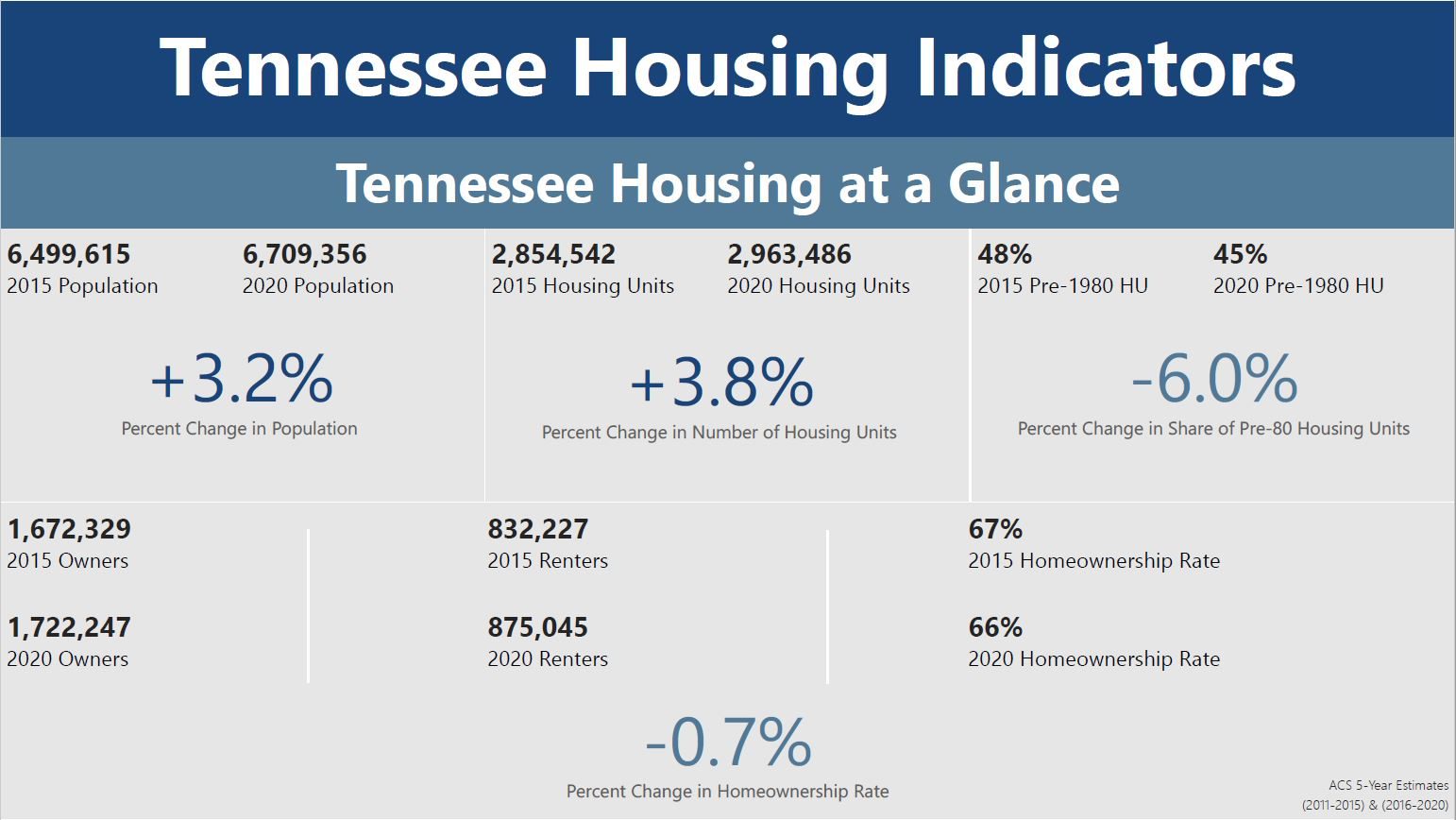

The Housing Indicators page aims to offer a clear snapshot of the state of housing in 108 Tennessee geographies, including the entire state, its 95 counties, the three geographic regions of the state, and its nine development districts.

[November 2022]