Featured Reports

THDA’s Research and Planning Division conducts research that examines housing affordability and access in general within the state. Below are research reports that are at times more in depth than our traditional program evaluations and analyses. Often more than one program is examined or housing resources outside of THDA are utilized to examine housing and housing affordability experiences and trends in Tennessee.

| The Need for Affordable, Accessible Service Enriched Housing for Older Adults in TennesseeThe aging of the baby boomer generation, increasing life expectancy and declining birthrates are all contributing to a significant shift in the percent of the population over the age of 65. As the older adult population grows, the number of vulnerable seniors —disabled, very low income and/or housing cost burdened—is also projected to increase. This demographic trend will likely strain existing housing, health and human services resources.[May 2017] |

| Keep My Tennessee Home: The First Five YearsThis report looks at the Housing Finance Agency (HFA) Hardest Hit Fund (HHF) Program administered by the Tennessee Housing Development Agency (THDA) between January 2011 and December 2015. The Hardest Hit Fund Program was established to restore stability in the housing market as one of the programs under the Troubled Assets Relief Program (TARP). A total of 7,355 were assisted with the Treasury’s HHF Program, and as of December 31, 2015, a total of $169.9 million of assistance was provided.[August 2016] |

| Aging Affordable Rental Housing in TennesseeDeeply subsidized housing properties in Tennessee, such as project based Section 8 properties, USDA properties and public housing largely were built more than 30 years ago and have significant deferred maintenance due to reductions in funding for those programs in recent years. The purpose of this report is to describe the age and physical condition of existing affordable rental housing properties in Tennessee, along with other risk factors for loss of affordable units, such as rental assistance contract expiration dates, to guide future discussions around affordable housing preservation in Tennessee.[March 2016] |

| Tennessee's Low Income Housing Tax Credit ReportThe purpose of this report is to describe the characteristics of properties developed through the LIHTC program over time, the relationship to state and federal policy priorities, such as the Qualified Allocation Plan (QAP), as well as the relationship to market and investment conditions. The report discusses type and size of developments, unit mix within developments, location and spatial characteristics of developments, such as location in high poverty or high unemployment tracts and the relationship of the LIHTC program to other subsidized housing programs.[May 2015] |

| 40 Years of Single Family Homeownership ProgramsYear 2013 marked THDA’s 40th year assisting over 107,000 Tennesseans into the security of homeownership. We will look at the different types of loans that were available in these programs and the economic impact generated through THDA’s homeownership program during 40 years of operations. We will compare the demographic characteristics of borrowers and of loan and property characteristics over the years.[August 2013] |

| Tennessee Housing Needs AssessmentThis housing needs assessment was conducted in order to identify some of Tennessee’s most pressing housing needs, describe programs already available to assist with those needs, and detect which needs are going unmet. On the whole, this assessment shows that federal, state, and local organizations have summoned significant resources to combat housing needs across state, but they have been insufficient to ensure every Tennessean lives in a safe, sound and affordable home.[September 2012] |

| Tennessee's Housing Trust Fund: The First 5 YearsIn 2006, the Tennessee Housing Development Agency (THDA) started the state’s Housing Trust Fund (HTF) to address unmet housing needs inTennessee. The HTF is composed of four distinct programs and serves very low income households. After the first five years of the Housing Trust Fund, we are taking a look at how THDA has achieved the original goals of the Fund; the impact of the Fund; and the remaining housing need in the state. [September 2011] |

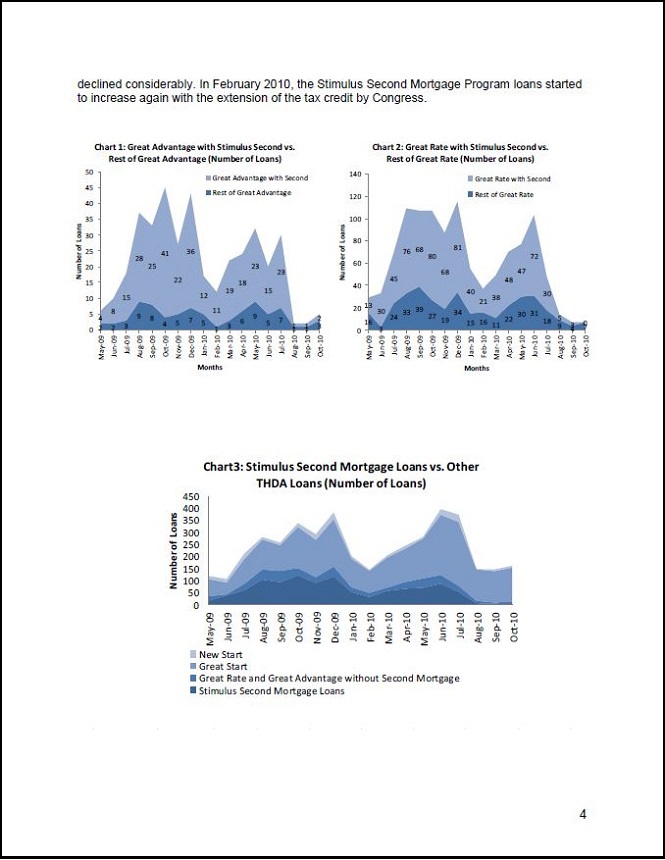

| THDA Stimulus Second Mortgage Program ReportIn April 2009, THDA implemented the Stimulus Second Mortgage Program to monetize the federal ARRA home buyer tax credit. THDA borrowers could receive the federal ARRA homebuyer tax credit through traditional ways of filing with the IRS regardless of participation in the THDA Stimulus Second Mortgage Program. This report includes the loans funded under this program from May 2009 to November 2010.[January 2011] |

| A Housing Dollar Well-SpentThe Social and Economic Impacts of Affordable Housing DevelopmentThis study introduces the multi-faceted role that THDA’s affordable housing efforts play in communities across Tennessee. The study does not cover all THDA programs and activities but selects three examples that involve multiple segments of society by age, gender, income, and vulnerability. Each story shows “a housing dollar well-spent."[May 2010] |

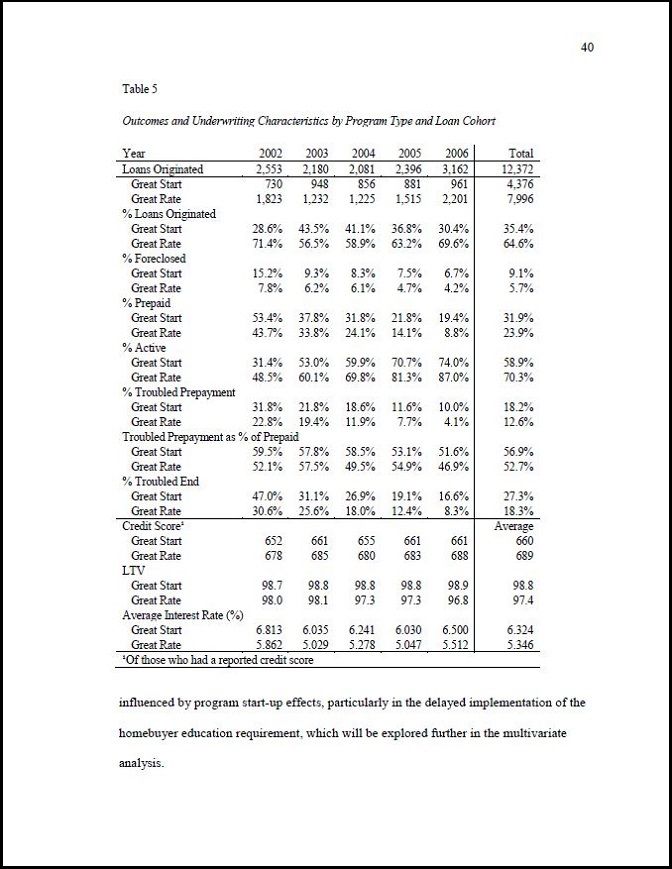

| Risk Reduction and Sustainable LendingThe Effect of Pre-Purchase Homebuyer Education on Mortgage ForeclosureTo this date, the effects of homebuyer education, which has become a key tool in low-income lending because of its wide ranging use, practicality, and perceived utility in reducing foreclosure risk, have been relatively untested. This paper is an effort to lay out a conceptual model for how homebuyer education may contribute to sustainable homeownership and to contribute to the empirical knowledge base of the effects of homebuyer education.[January 2010] |

For further inquiries about past and upcoming publications, email Research and Planning.