Contact Research and Planning

By: tadminAndrew Jackson Building

502 Deaderick St, 3rd Floor

Nashville, TN 37243

Phone: 615-815-2125

What can we help you find ?

Andrew Jackson Building

502 Deaderick St, 3rd Floor

Nashville, TN 37243

Phone: 615-815-2125

To keep assisted housing affordable for lower-income households, federal housing law directs that the resident’s share of rent in federally assisted public housing should equal 30 percent of the household’s adjusted monthly income. In interpreting the federal housing law, HUD has defined the Total Resident Payment for “rent” to include both shelter and the costs for reasonable amounts of utilities. The amount determined necessary to cover the resident’s reasonable utility costs is the utility allowance.

At the time a Request for Tenancy Approval is signed, and at every subsequent recertification, a determination of utilities and/or services paid by the tenant is made. These obligations are shown on the Utility Allowance Schedule according to the county, the unit type (house, duplex/townhouse, apartment or mobile home), and the unit size. The unit size is determined by counting the bedrooms (regardless of how the bedroom is utilized, such as a sewing room or study). Please keep in mind that to be counted as a bedroom, the room must meet all the Housing Quality Standards requirements for a bedroom (presence of a window, door for privacy, smoke detector located outside of the room, etc.). Rooms used for sleeping purposes (such as the living room or den) are not to be included in determining unit size. The total utility obligation of the tenant equals the Utility Allowance.

If the Utility Allowance is greater than the tenant’s Total Tenant Payment, a Utility Reimbursement is sent to the tenant. The reimbursement equals the amount that the Utility Allowance exceeds the TTP. If the TTP is greater than the Utility Allowance, the tenant pays a portion of the rent to the landlord. This payment equals the amount that the TTP exceeds the Utility Allowance.

The utility allowance is added to the contract rent to determine the gross rent for the unit. For more information, please reference the methodology and instructions linked below.

2024 Utility Allowance Methodology

Instructions for 2024 Utility Allowances updated

When the Utility Allowance exceeds the Total Tenant Payment of the family, THDA will provide a Utility Reimbursement Payment to the family each month. The utility reimbursement will be paid directly to the tenant.

There are currently no open public notices.

In the recently released 2024-2025 Consolidated Annual Performance and Evaluation Report (CAPER), the Tennessee Housing Development Agency (THDA) describes how federal CDBG, ESG, HOME, HOPWA, and HTF funds were spent on housing and community development activities to benefit low-and-moderate income Tennesseans.

The FY 24-25 CAPER will be available for review and public comment from September 3-18, 2025.

FY 24-25 CAPER overview

FY 24-25 CAPER draft

Comment on the FY 24-25 CAPER

Public meeting:

Wednesday, September 17, 2025, 1:00 – 2:00 PM CST

Andrew Jackson Building, Ground Floor Hearing Room, 502 Deaderick Street, Nashville, TN 37243

The building is ADA accessible with ground-level entry on Fifth Avenue.

Additionally, participants can join the public meeting virtually using this link.

For questions and accommodations, contact Amara Mattingly at research@thda.org.

En el recientemente publicado Informe Consolidado de Desempeño y Evaluación 2024-2025 (CAPER, por sus siglas en inglés), la Agencia de Desarrollo de Vivienda de Tennessee (THDA, por sus siglas en inglés) describe cómo fondos federales de CDBG, ESG, HOME, HOPWA y HTF fueron usados en actividades de vivienda y desarrollo comunitario para beneficiar a habitantes de Tennessee de bajos y moderados ingresos.

El CAPER estará disponible para su revisión y comentarios del 3 al 18 de septiembre de 2025 durante el periodo formal de comentarios públicos.

Visión general de CAPER.

Haga clic aquí para comentar sobre el CAPER.

Los detalles de la reunión pública figuran a continuación:

miércoles, 17 de septiembre de 2025, 1:00 – 2:00 PM CST

Andrew Jackson Building, Ground Floor Hearing Room, 502 Deaderick Street, Nashville, TN 37243El edificio cuenta con accesibilidad ADA, con entrada terrestre en el primer piso a través la Quinta Avenida (Fifth Avenue, en inglés).

Además, los participantes pueden asistir virtualmente a la reunión pública mediante este enlace.

Si tiene preguntas o necesita algún ajuste comuníquese con Amara Mattingly en research@thda.org.

Public Housing Authorities, Continuum of Care applicants and applicants to other affordable housing grant/loan programs (e.g. the Federal Home Loan Bank) are required to gain certification from the jurisdiction in which their grant will do their work that the proposed activity is consistent with the jurisdiction’s HUD Consolidated Plan.

When requesting a certification of consistency with the state’s Consolidated Plan, please supply the following information to ensure that Tennessee Housing Development Agency has the information needed to certify.

If demolition is proposed, PHAs should submit plans for approval at least one month prior to submission of their plan to HUD. Additional information may be required.

The state’s certification must show how the activities proposed contribute to affirmatively furthering fair housing. A sentence or two describing this for the certification is helpful to getting the certification finalized. More information may also be included in the summary to help explain the anticipated fair housing implications.

Please fill out the appropriate request form and submit it with the overall summary.

Certification for PHAs (HUD Form 50077-SL)

Applicants for HUD funding to be certified consistent (Form HUD-2991)

CoC applicants to be certified consistent (Form HUD-2991 CoC Program Competition)

Please allow THDA a minimum of two weeks (minimum of one month for demolition) to review all requests and have certifications returned. All requests for Certification of Consistency with the Consolidated Plan forms should be sent via email to research@thda.org.

The Consolidated Plan combines the planning, application, and reporting processes for five U.S. Department of Housing and Urban Development (HUD) grant programs:

Community Development Block Grant (CDBG)

Emergency Solutions Grant (ESG)

HOME Investment Partnership Program (HOME)

Housing Opportunities for Persons with AIDS Program (HOPWA)

National Housing Trust Fund

These funds are utilized to support a variety of housing and community development programs and projects throughout Tennessee, primarily for the benefit of low- and moderate-income households. As a recipient of these funds, the State is required to prepare and submit a Consolidated Plan to HUD every five years. The newest Consolidated Plan covers 2020-2024.

The Consolidated Plan examines the current housing situation, explore the housing and community development needs of the State, and set priorities for spending HUD grant monies. This document serves as a guide in helping the State of Tennessee meet affordable housing, community development, economic development, public service, and fair housing needs over the next five years. The Consolidated Plan also addresses the changing external factors influencing existing programs and the need to be accountable for the resources Tennessee has been granted or will coordinate.

THDA issue briefs are a series of short and informative research reports developed by the THDA Research and Planning Division. Covering a wide range of topics, these briefs provide an unbiased analysis of timely housing and housing affordability issues impacting the State of Tennessee and beyond.

THDA offers various homeownership programs to assist Tennesseans of low and moderate incomes. Single Family Loan Program Reports discuss the different types of loans available, analyze the data and activities of THDA single family programs, and determine the economic impact generated through these programs.

All Tennesseans ideally would have a full continuum of housing options available in their communities, from supportive housing to market-rate homeownership. A full continuum of housing options available enables households to move rightward more easily toward greater levels of housing stability and wealth. In addition, a full continuum of housing options ensures households who experience hardships can move leftward without necessitating housing instability.

The Tennessee Housing Development Agency, on behalf of the State of Tennessee, conducted a housing needs assessment and market analysis for each of Tennessee’s nine development districts as part of the State’s 2025-2029 Consolidated Plan. The assessment included analysis of publically available data, like the American Community Survey (ACS) and Comprehensive Housing Affordbility Strategy (CHAS), as well as the results of a survey of Tennesseans’ housing needs and focus groups on housing affordability, homelessness, and fair housing.

Housing Needs and Market Analysis for the East Tennessee Development District – March 2025

Housing Needs and Market Analysis for the First Tennessee Development District – March 2025

Housing Needs and Market Analysis for the Greater Nashville Regional Council – March 2025

Housing Needs and Market Analysis for the Midsouth Development District – March 2025

Housing Needs and Market Analysis for the Northwest Tennessee Development District – March 2025

Housing Needs and Market Analysis for the South Central Tennessee Development District – March 2025

Housing Needs and Market Analysis for the Southeast Tennessee Development District – March 2025

Housing Needs and Market Analysis for the Southwest Tennessee Development District – March 2025

Housing Needs and Market Analysis for the Upper Cumberland Development District – March 2025

Housing Needs Meeting for East Tennessee – August 14, 2024

Housing Needs Meeting for First Tennessee – August 14, 2024

Housing Needs Meeting for the Greater Nashville Regional Council – August 6, 2024

Housing Needs Meeting for Midsouth Tennessee – August 8, 2024

Housing Needs Meeting for Northwest Tennessee – August 8, 2024

Housing Needs Meeting for South Central Tennessee – August 14, 2024

Housing Needs Meeting for Southeast Tennessee – August 13, 2024

Housing Needs Meeting for Southwest Tennessee – August 13, 2024

Housing Needs Meeting for Upper Cumberland Tennessee – August 12, 2024

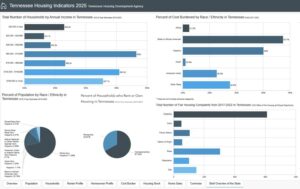

THDA’s Housing Indicators is a GIS tool designed to help users explore and interact with a range of housing-related metrics for Tennessee’s 95 counties. Users can explore trends in Tennessee’s population, households, renter housing and households, owner housing and households, overall housing stock, home sales, transportation, and experiences of cost burden.

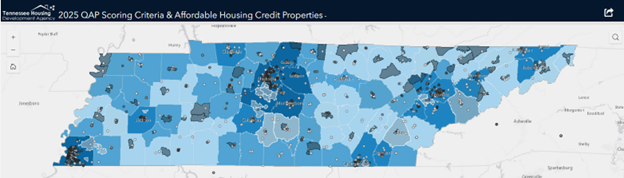

We are proud to present THDA’s new 2025 QAP Scoring Criteria & Affordable Housing Credit Properties Map. This online tool allows users to search and browse the Affordable Housing Credit (also known as the Low-Income Housing Tax Credit [LIHTC]) properties that have either been placed in service or are in pipeline. Also included on this GIS page are select criteria for the 2025 Qualified Allocation Plan including the county geographic pools, the county location score, the number of unduplicated units by county, urbanicity, and other select information at the county and census tract level. Finally, this page also includes general information about the program including, reports and data regarding all active and pipeline properties in Tennessee. This map uses data current as of August 2024.