Lender Training

THDA offers live and pre-recorded trainings. For individual assistance or questions, please email us.

NEW LENDER PORTAL TRAINING

Please click the link below to register for new portal training. This week's offering is August 20 at 12:30PM CT/1:30PM ET .

Daily Morning Options from August 25-29

August 25 at 9:30 AM CT/10:30 AM ET

August 26 at 9:30 AM CT/10:30 AM ET

August 27 at 9:30 AM CT/10:30 AM ET

August 28 at 9:30 AM CT/10:30 AM ET

August 29 at 9:30 AM CT/10:30 AM ET

Daily Afternoon Options from August 25-29

August 25 at 1:00PM CT/2:00 PM ET

August 26 at 1:00PM CT/2:00 PM ET

August 27 at 1:00PM CT/2:00 PM ET

August 28 at 1:00PM CT/2:00 PM ET

August 29 at 1:00PM CT/2:00 PM ET

Lender Q&A Training is back!

The panel will provide a brief presentation along with answering the most frequently asked questions. There will be time at the end for any participant questions related to the program.

September 11 at 1:00PM CT/2:00PM ET

Topic: Homebuyer Education eHomeAmerica vs. THDA Certificates and Transfer and Agency Processes

Homebuyer Education FAQ

Learn how to help your client find the right Homebuyer Education class and ensure they have a great experience with every part of the loan process. This short video covers questions most frequently asked by THDA Lenders.

Click here for video. Approximately 5 minutes.

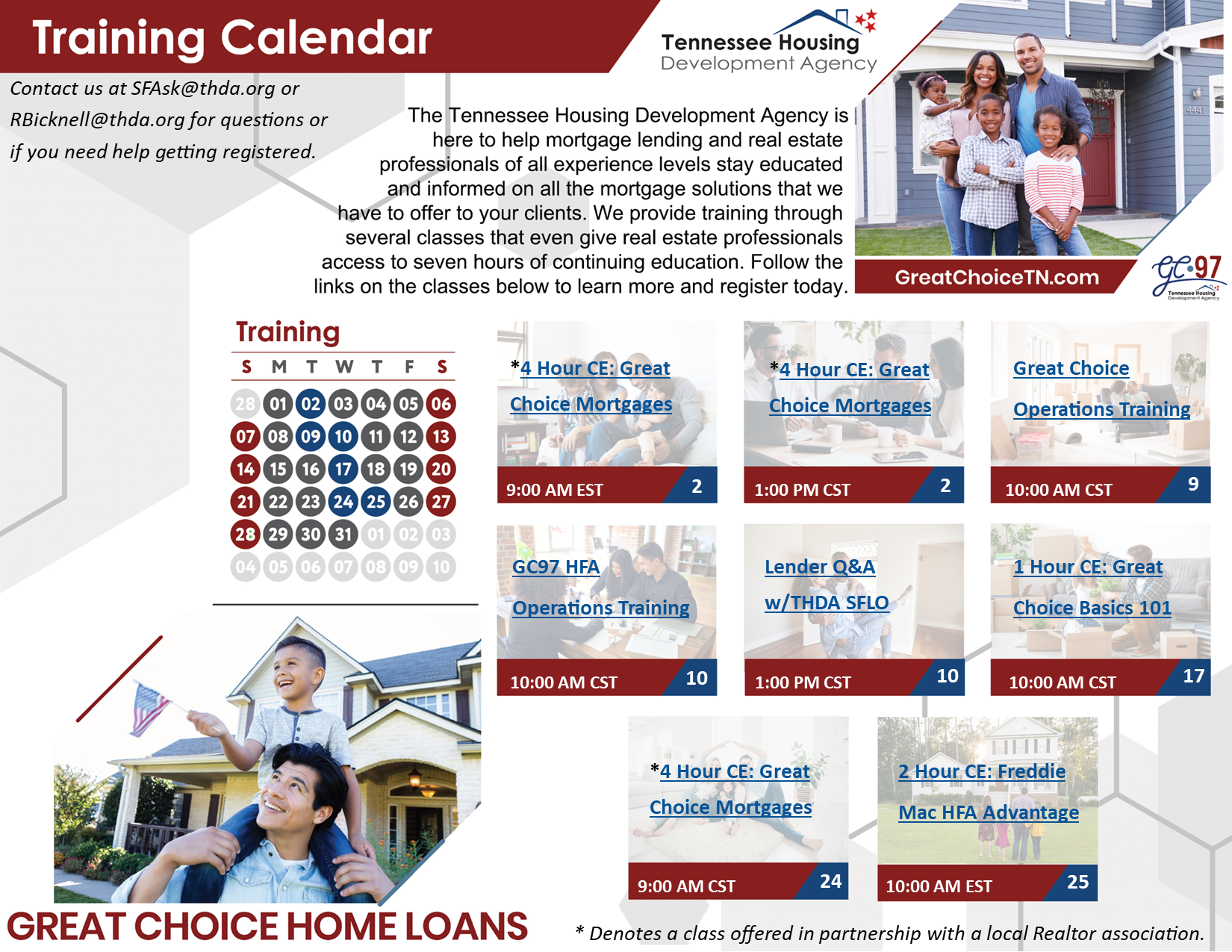

Great Choice and HFA Advantage Operations Training

This training covers all the basics of the Great Choice Loan Program and is recommended for all newly approved lenders, as well as a refresher course for experienced staff. Topics include eligibility criteria, Homebuyer Education requirements, Rate Lock & Loan Submission, Underwriting, Closing & Funding requirements, and processes for each execution. While this is a prepared presentation, we will still leave plenty of time at the end for questions.

Click here to contact Rebekah Bicknell and request onsite or virtual training for your team. Please enter "Lender Training" in subject line.

Schedule for 2025:

Morning Sessions 9:00 AM-10:30 AM Central/ 10:00 AM-11:30 AM Eastern

- September 10 Topic: Great Choice

- October 8 Topic: HFA Advantage

- November 12 Topic: Great Choice

- December 10 Topic: HFA Advantage

Afternoon Sessions 1:00 PM- 2:30 PM Central/ 2:00 PM- 3:30 PM Eastern

- September 10 Topic: HFA Advantage

- October 8 Topic: Great Choice

- November 12 Topic: HFA Advantage

- December 10 Topic: Great Choice